Will European Banks Act on Accessibility Before It’s Too Late?

Introduction

The European Accessibility Act deadline — June 28, 2025 — has now passed. In our previous blog, we explored what exactly needs to be accessible and how accessibility has evolved beyond being just a legal requirement into a business necessity.

Now, let’s address the elephant in the room: Financial Services. Banks and fintech companies are inadvertently turning away millions of potential customers due to inaccessible digital platforms, and time is running out to rectify this issue.

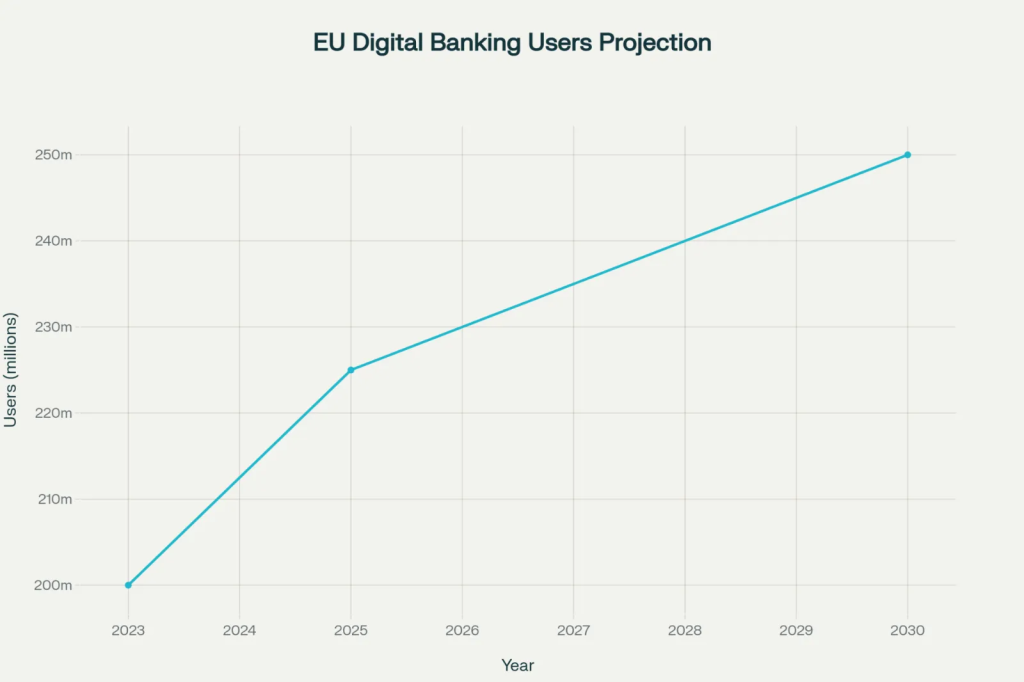

The EU has over 200 million digital banking users, growing at an annual rate of 8% since 2018, driven by digital-first consumer behavior and the convenience of online banking. However, with one in four Europeans living with some form of disability, approximately 50 million digital banking users face accessibility barriers when trying to access financial services online. This represents a massive underserved market that banks can no longer afford to overlook—especially with compliance just weeks away.

The Most Common Banking Accessibility Failures

The devil is in the details when it comes to banking accessibility. What might seem like minor oversights to developers can create insurmountable barriers for users with disabilities, often leading to lost customers and missed opportunities. Across both mobile and desktop devices, banking platforms often fall short on fundamental accessibility requirements such as:

Unlabeled Form Fields: The Silent Barrier

Picture this scenario: A visually impaired customer uses a screen reader to apply for a personal loan. They navigate through the application form, but encounter an unlabeled checkbox. The screen reader announces nothing—just silence. Unable to determine what the field represents, they skip it and apply.

What they don’t realize is that the checkbox asked: “Are you a senior citizen?” Checking it would have qualified them for a 0.5% interest rate reduction. The customer later discovers this benefit through a friend and, feeling frustrated by the poor digital experience, decides to take their business to a competitor who offers a more accessible platform.

Keyboard Navigation

Poor keyboard navigation creates significant barriers for users with limited hand mobility. Consider a customer trying to transfer funds using only keyboard navigation. They successfully fill in the transfer amount and recipient details, but when they press Tab to reach the “Confirm Transfer” button, their keyboard focus gets trapped in a dropdown menu. Unable to escape this menu or complete the transfer, they abandon the transaction and call customer service—turning what should have been a 2-minute online task into a 20-minute phone process.

Pictorial representation of common accessibility issues in banking applications

Color-only Information

Banks often use color coding to convey critical information—red for overdue payments, green for successful transactions, or yellow for pending actions. A customer with color blindness logs into their account to check their credit card status. The interface shows their payment status in red text against a dark background, but without any additional visual indicators like icons or text labels. Unable to distinguish the warning color, they miss that their payment is overdue, resulting in late fees and potential credit score impacts.

The Mobile Banking Accessibility Gap

With over 75% of banking interactions now happening on mobile devices, the accessibility challenges are even more pronounced on smaller screens.

While being both handy and convenient, mobile banking applications have their own set of digital accessibility challenges.

Image: Banking apps accessibility gaps for mobile devices

Touch target issues: Buttons and links are too small for users with motor impairments to accurately tap, leading to frequent mis-taps and frustration.

Screen reader incompatibility: Many mobile banking apps lack proper semantic markup, causing screen readers to announce buttons as “button” without describing their function.

Gesture-only navigation: Apps that rely solely on swipe gestures exclude users who cannot perform these motions, particularly those using assistive technologies.

Zoom and magnification problems: Text and interface elements that break or become unusable when users zoom in to 200% or higher magnification levels.

Beyond Compliance: The Real Financial Impact on Banks

Non-compliance with the EAA can result in fines up to 4% of annual turnover—potentially millions for major banks. But the hidden costs are even more significant:

- Lost Revenue: 50 million potential customers represent billions in untapped deposits, loans, and service fees

- Increased Support Costs: Inaccessible digital platforms force more customers to expensive phone and branch services

- Reputation Damage: Public accessibility failures can trigger negative media coverage and social media backlash

- Legal Exposure: Accessibility lawsuits against financial institutions have increased 300% in recent years

The Human Impact

For users with disabilities, inaccessible banking creates:

- Financial exclusion: Inability to access competitive rates and services available only online

- Privacy concerns: Forced reliance on family members or caregivers for sensitive financial tasks

- Time and stress: Simple transactions become complex, multi-step processes

- Economic disadvantage: Missing out on digital-only promotions and better interest rates

The Opportunity

Turning compliance into competitive advantage. Banks that act now don’t just avoid penalties—they gain first-mover advantage in a massive, underserved market. The global market for digital accessibility software reached USD 721.1 million in 2023, with a net projection of USD 1300 million by 2030, a CAGR of 9.2%.

The gross revenue from the European accessibility market in 2023 was around $176M growing at an average of 8.2%. This only signals one thing – enterprises across are shifting towards being digital inclusive and accessible. Being an early adopter of the shift means that you are well ahead of the game than your competitors.

In the specific cases of banks, digital payments peak during the holiday season — after all, who’s paying for those Secret Santa gifts? Buy Now, Pay Later (BNPL), of course. This has brought about a rapid change in how people buy and consume goods, and this, in turn, has changed the way people use of digital banking services.

Europe’s digital banking sector is experiencing unprecedented growth in 2025. The market is projected to expand from USD 10.14 billion in 2025 to USD 35.36 billion by 2033—at a CAGR of 16.9%, with nearly 70% of Europeans now preferring digital channels for everyday banking. As European banks modernize, regulation has stepped up as well: The European Accessibility Act (EAA) comes into full force this year. It mandates that all banking platforms—from mobile apps to payment terminals—must be accessible to users with disabilities, instantly raising the bar for digital inclusion.

Source: MarketDataForecast, April 2025

Early accessibility leaders report increases in customer loyalty, market differentiation, the innovation catalyst, and regulatory confidence as key positive indicators of being an early adopter of digital accessibility, especially the tag of being an ‘accessible platform’, which can be a huge boost both for the business and for making it more trustworthy.

Ready to Transform Your Digital Banking Experience?

With the EAA deadline now behind us, every day of delay adds to both the compliance risk and the technical challenges of remediation. Banks that begin accessibility improvements today can still meet compliance standards and unlock valuable market opportunities. The real question isn’t whether your bank needs to improve accessibility—it’s whether you’ll approach this as a compliance challenge or leverage it as a competitive edge. Contact Innovature today for an emergency accessibility assessment. Let’s turn your compliance challenge into your competitive edge.